Q3 2021 Financials

Revenue: US$ 14.88 Billion

Gross Margin: 51.3%

Operating Margin: 41.2%

Net Profit Margin: 37.7%

Shipment: 3.646 M 12-inch equivalent wafers

Capital Expenditure: NT$ 189 Billion

Days of Inventory: 85

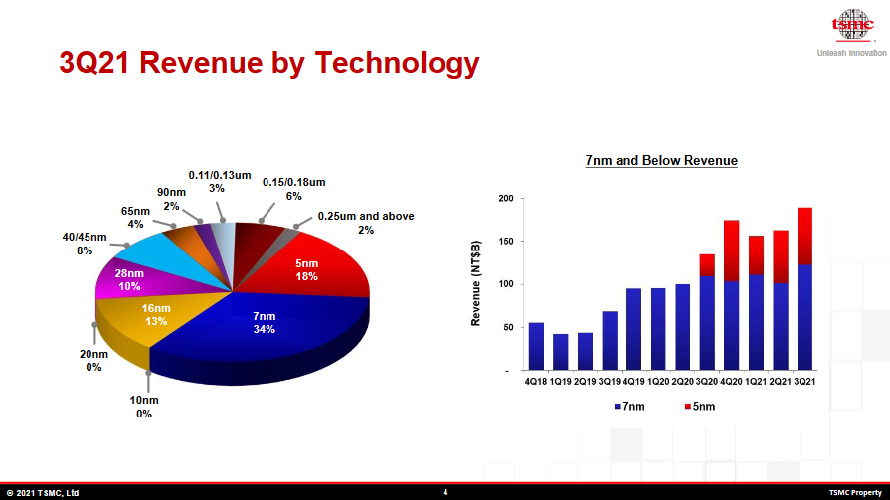

Revenue by Technology

- Advanced Nodes (<=N7) make up 52% of revenue

- Nodes from 16nm - 65nm make up 31% of revenue

- N5 revenue QoQ increased by <7.5%

- N7 revenue QoQ increased by ~20%

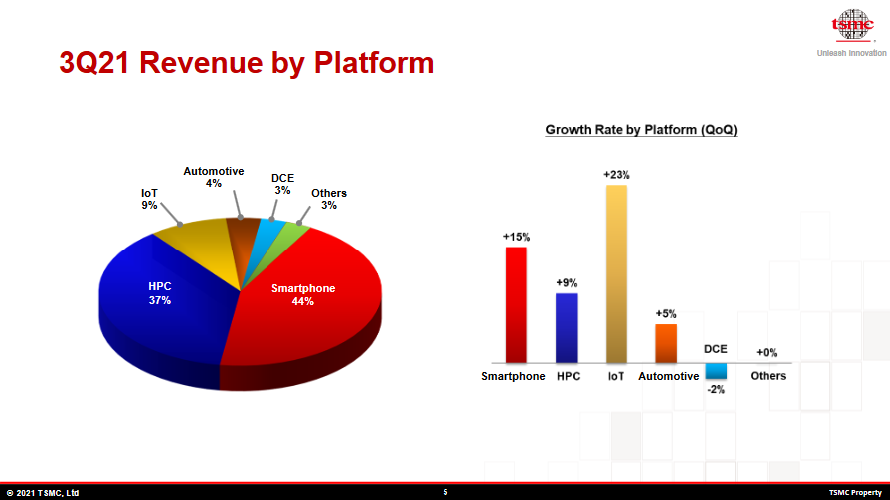

Revenue by Platform

- Smartphones and HPC make up a massive 81% of revenue

- IoT revenue QoQ increased by 23%

- DCE revenue QoQ decreased by 2%

Q4 Guidance

- Revenue: US$ 15.4 Billion - US$ 15.7 Billion

- Gross Margin: 51% - 53%

- Operating Margin: 39% - 41%

Japan Expansion

- Process Nodes: 22ULP and 28nm

- Construction Start: 2022

- Production Start: Late 2024

- No oversupply as it uses specialty technologies

- Not included in US$ 100 Billion Capital Expenditure by 2023

Future Nodes

- Competitive Schedule

N3

- Risk Production: 2021 (Schedule)

- Production (HVM): H2 2022

- Most advanced foundry technology in PPA and transistor technology [3GAE with GAAFET is in 2022, so the latter is doubtful]

- Large and long-lasting node

- Expected Tapeouts: More than N5 for the first year

- Cost: Higher than N5 (Technological complexity and new equipment)

- Ramp-up similar to N5

- Revenue will be seen in Q1 2023 [Q4 2022 HVM with long cycle times]

N3E

- Extension of N3

- Improved Performance, Power and Yield

- Production (HVM): H2 2023

- Enhanced manufacturing window [Shorter cycle time]

- [Most likely the “Less EUV” node that has been reported]

N2

- Density and performance will be the most competitive in 2025 [>2 year cadence]

- GAA Structure is considered

- [Dodging question about Intel’s process technology plans]

Capacity

- Capacity will remain very tight in 2021 and throughout 2022

- Does not rule out the possibility of an inventory correction

- Believes a correction could be less volatile due to increased focus on 5G and HPC

- Fab utilisation continues to be high

- More customers are making pre-payments to secure capacity

Capital Expenditure

- Still able to achieve >=50% margins despite higher capital expenditure per thousand wafers

- Mature node expansions will continue

New Fabs

- Does not consider Joint Ventures with governments

- Prefers to own 100% of overseas fabs

Automotive Supply Chains

- More complicated than initially thought

- Only participates in 15% of automotive ICs

- Cannot solve industry’s supply challenges

- Wafer substrate supply should improve in the third quarter [2022?]

Other

- Strategic, not opportunistic pricing